Acquirements

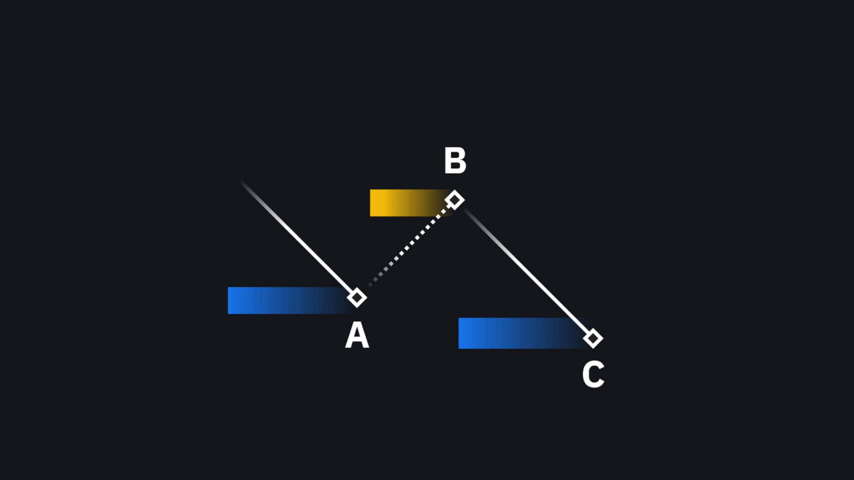

- Basic concepts of the method

- Drawing of candlestick charts

- Interpreting price movements

- Understanding buy and sell signals

Tutors

Ahmet Mergen

Strategist

Course Content

8 chapters144 videos24 hour 13 minute total time

Introduction

- History and General Information of Candlestick Charts26:25

- Fundamental Concepts in Candlestick Charts09:06

- Drawing Candlestick Charts10:35

Short and Long Candle Bodies in Candlestick Charts

- Short and Long Candle Bodies08:06

- Short and Long Candle Bodies at the Close07:33

- Short and Long Candle Bodies Example 105:57

- Short and Long Candle Bodies Example 203:12

- Short and Long Candle Bodies Example 303:07

- Short and Long Candle Bodies Example 406:00

Marubozu Siblings in Candlestick Charts

- Marubozu Siblings04:15

- Opening and Closing Marubozu Siblings06:34

Short and Long Shadows in Candlestick Charts

- Connections Between Short and Long Shadows11:49

Patterns in Candlestick Charts

- Reversal or Indecision Patterns01:52

- Engulfing Patterns09:38

- Four-Price Doji02:21

- Rickshaw Man Pattern06:42

- Rickshaw Man Pattern Example04:02

- Dojis08:53

- Dojis and Trends20:00

- Long-Legged Doji02:11

- Dragonfly and Gravestone Doji Patterns08:58

- Bulls and Bears03:40

- What Candles Don't Tell Us03:41

- Candle Positions, Stars, and Doji Stars07:42

- Harami Example 105:32

- Harami and Harami Cross Patterns06:26

- Harami Example 203:09

- Harami Example 304:08

- Harami Cross Example 403:45

- Hammer, Hanging Man, Inverted Hammer, Shooting Star Patterns21:14

- Reversal Signals09:29

- Hammer or Hanging Man Pattern12:41

- Hammer Pattern Example05:28

- Hanging Man Pattern05:43

- Hanging Man Pattern Example09:04

- Inverted Hammer Pattern03:39

- Bullish Engulfing Candlestick14:14

- Bullish Engulfing Candlestick Example06:54

- Bearish Engulfing Candlestick11:23

- Bearish Engulfing Candlestick Example06:47

- Analysis of Following Candles after Engulfing Candles22:17

- Bullish Piercing Line and Candle Body12:14

- Piercing Line and Candle Body Example06:03

- Piercing Candle Body Studies 105:53

- Piercing Candle Body Studies 207:39

- Dark Cloud Cover12:11

- Studies on Dark Cloud Cover08:52

- Dark Cloud Cover Example 112:33

- Dark Cloud Cover Example 208:01

- Harami Pattern08:49

- Harami Patterns Generating Up and Down Signals13:36

- Harami Cross Pattern07:58

- Shooting Star and Inverted Hammer Patterns23:02

- Morning Star and Evening Star11:48

- Stars and Doji Stars13:21

- Star Pattern Example 105:24

- Star Pattern Example 204:35

- Evening Doji Star04:37

- Morning Doji Star05:23

- Morning Star Pattern07:14

- Abandoned Baby Pattern07:52

- Applications and Examples25:03

- Three Inside Up Pattern07:25

- Two Crows Pattern10:07

- Two Crows Pattern Example05:31

- Meeting Lines Pattern09:12

- Belt Hold Pattern11:05

- Unique Three River Bottom Pattern10:50

- Three White Soldiers Pattern21:45

- Three Advancing White Soldiers05:40

- Stick Sandwich Pattern09:35

- Kicking Pattern17:20

- Homing Pigeon Pattern08:35

- Ladder Bottom Pattern04:04

- Equivalent Low Closes13:09

- Tasuki Gap Patterns10:34

- Sequential White Candles05:10

- Rising and Falling Three Methods08:10

- Separating Lines09:20

- Mat Hold Pattern07:41

- Three Crows and Counterattack08:32

- Thrusting Pattern06:24

- Bullish Doji Engulfing06:28

- Bullish Doji Engulfing Example06:49

- Bearish Doji Engulfing05:12

- Bearish Doji Engulfing Example16:14

- Analysis of Following Doji Engulfing Patterns09:27

- Bullish Belt Hold12:31

- Bearish Belt Hold07:01

- Three-Line Strikes08:52

- Three White Soldiers and On-Neck02:36

- On-Neck Pattern Example11:05

- In-Neck and Thrusting Patterns08:01

- In-Neck and On-Neck Patterns Example04:55

- Pushing Pattern05:34

- Sakata Methods05:37

- Eight-Row Candle and Sell19:06

- Eight-Row Candle and Sell03:41

- Tweezer Tops, Unique Peaks and Bases22:22

Sample Studies in Candlestick Charts

- Summary Images17:53

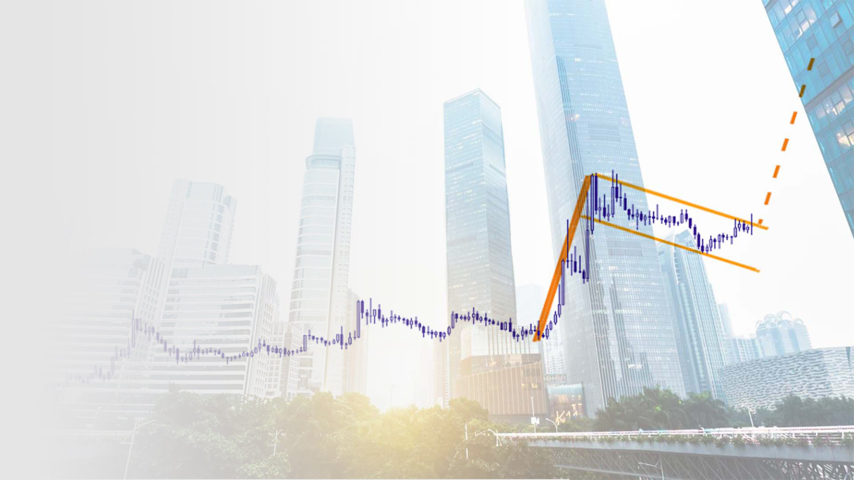

Candlestick Charts and Peaks

- Peaks Example 111:57

- Peaks Example 210:03

- Support and Resistance Example 120:24

- Support and Resistance Example 211:28

- Support and Resistance Example 316:22

- Support and Resistance Example 415:06

- Support and Resistance Example 508:27

- Downtrend Example 110:39

- Downtrend Example 209:35

- Downtrend Example 309:38

- Sideways Trends Example 111:36

- Sideways Trends Example 210:54

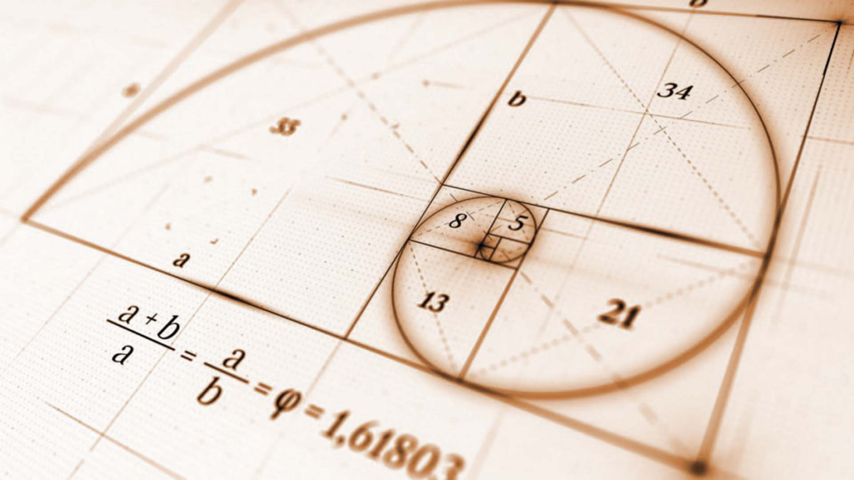

- Fibonacci Ratios Example 109:22

- Fibonacci Ratios Example 207:58

- Fibonacci Ratios Example 307:55

- Fibonacci Ratios Example 407:21

- Fibonacci Ratios Example 5.106:28

- Fibonacci Ratios Example 5.209:58

Candlestick Formations and Indicators

- MACD Indicator Example 116:21

- MACD Indicator Example 218:47

- MACD Indicator Example 312:37

- MACD Indicator Example 417:17

- MACD Indicator Example 509:39

- Moving Averages Example 116:46

- Moving Averages Example 220:38

- Moving Averages Example 309:28

- RSI Indicator Example 112:42

- RSI Indicator Example 215:43

- RSI Indicator Example 309:13

- WilliamsR Indicator Example 118:18

- WilliamsR Indicator Example 213:31

- WilliamsR Indicator Example 312:54

- CCI Indicator Example 116:59

- CCI Indicator Example 213:09

- Momentum Indicator Example 107:05

- Momentum Indicator Example 217:05

- Stochastics Indicator Example 114:49

- Stochastics Indicator Example 209:56

- Bollinger Bands Example 113:03

- Bollinger Bands Example 212:43

- Bollinger Bands Example 310:57

- Bollinger Bands Example 409:56

- Bollinger Bands Example 507:35

- Bollinger Bands Example 610:02